What Are Fig Notes

On Fig, structured products are called notes.

Notes gives you a variable return on your principal based on the performance underlying asset at maturity date.

In general, a note is a combination of:

- A

fixed income instrumentsuch as US Treasury T-bill, and - A set of derivatives positions with common risk and return properties that provides directional exposure to the

underlying asset.

Each notes have the following common attributes:

Maturity dateis the date on which thenotematures and theprincipal+variable yield(if any) are paid out.Principalis the amount of USD that an investor used to purchase the note, denominated in USD based stablecoins.Variable returnis the return in addition to their principal, depending on the specifics of thenote.

By default all notes are 100% principal hedged. This means upon maturity date, the note promises the return of principal in USD, at minimum, to the noteholder.

All fixed income instruments used by Fig are US Treasury T-Bills, which are US treasury fixed income securities with maturity of less than 1 year.

They are credit risk-free instruments that guarantees repayment in USD upon maturity.

All notes promise the return of principal upon maturity date only.

If noteholder decides to sell a note prior to maturity, you may not get full principal back. The amount noteholder will receive prior to maturity date depends on market conditions. Fig does not guarantee any secondary market that may be available for any note. Please see risk disclosures.

Hedged Upside Capture Note

A Hedged Upside Capture Note is a structured note that captures return of a long position in underlying asset. The note is constructed with a set of call spread or call butterfly strategy combined with a fixed income instrument.

Payoff mechanics upon maturity (maturity date):

- If the price of

underlying asset>Price Target, the note will pay the investor theprincipal+variable yield. - If the price of

underlying asset<Price Target, the note will pay investor theprincipal.

Variable yield is determined by the quantity of the derivatives positions purchased and the price targets of the derivatives positions.

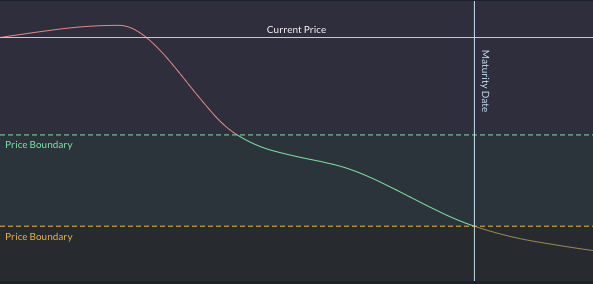

Hedged Downside Capture Note

A Hedged Downside Capture Note is a structured note that captures the return of a short position in underlying asset. The note is constructed with a set of put spread or put butterfly strategy combined with a fixed income instrument.

Payoff mechanics upon maturity (maturity date):

- If the price of

underlying asset<Price Target, the note will pay the investor theprincipal+variable yield. - If the price of

underlying asset>Price Target, the note will pay investor theprincipal.

Variable yield is determined by the quantity of the options positions purchased and the price targets purchased.

Fig Note - Downside Capture is a safer instrument to profit from price decline of underlying asset compared to naked shorting.

Naked shorting is subject to liquidation and unlimited loss. In comparison, Fig Note - Downside Capture will return 100% of investor's principal regardless of the price of the asset upon maturity date.

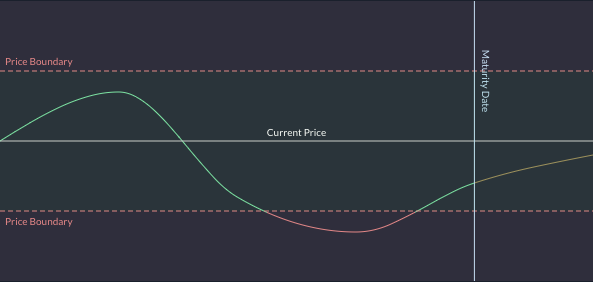

Hedged Yield Capture Note

A Hedged Yield Capture Note - is a structured note that uses a delta-neutral strategy to collect yield by selling volatility on both up and downside. This corresponds to market view of sideways. The amount of short volatility exposure is limited to the extent that the principal invested in the note is fully hedged.

The note is designed to be as delta-neutral as possible at inception. The delta of the note will drift over time depending on various factors.

Payoff mechanics upon maturity - maturity date:

- If the price of

underlying asset<Up Price Targetor price ofunderlying asset>Down Price Target, the note will pay the investor theprincipalandvariable yieldas per the note specs. - If the price of

underlying asset>Up Price Targetor price ofunderlying asset<Down Price Target, the note will pay the investor theprincipal

Variable yield is determined by the quantity of the options positions sold, depending on note specifications.

Investor can customize the price targets to increase the chance of earning the yields. Generally the higher the price targets, the less likely the yields will be clawed back.

Delta refers to the change in the return of a financial instrument relative to the change in the price of the underlying asset.

Upon initiation, the note's delta is close to zero. Since notes are unmanaged products, delta will drift over time depending on market conditions.

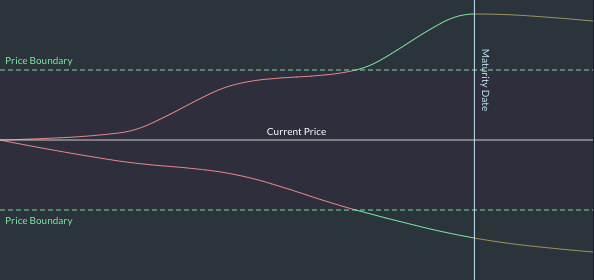

Hedged Volatility Capture Note

A Hedged Volatility Capture Note is a structured note that uses a delta-neutral strategy to capture returns from both up OR down side price movements of the underlying asset. This corresponds to market view of unsure.

The note combines fixed income instrument with a set of straddle - strangle options positions.

The note is designed to be as delta-neutral as possible at inception. The delta of the overall note will drift over time depending on various factors.

Payoff mechanics upon maturity - maturity date:

- If the price of

underlying asset>Up Price Targetor price ofunderlying asset<Down Price Target, the note will pay the investor theprincipalandvariable yieldas per the note specs. - If the price of

underlying asset>Up Price Targetor price ofunderlying asset<Down Price Target, the note will pay the investor theprincipal.

Variable yield is determined by the quantity of the options positions bought.

This note is the opposite of Delta Neutral Yield Note. It tend to perform well during high volatility markets, in which the direction of the underlying asset can move significantly in short periods of time.

Dual Currency Note - Crypto

Coming soon.